Learning Objectives

The student will describe the importance of earning an income and explain how to manage personal income through the use of a budget.

The student will identify and describe the impact of local, state, and federal taxes upon income and standard of living.

The student will describe the functions and uses of banks and other financial service providers.

The student will demonstrate the ability to manage a bank account and reconcile financial accounts.

The student will analyze the costs and benefits of saving and investing.

The student will explain and evaluate the importance of planning for retirement.

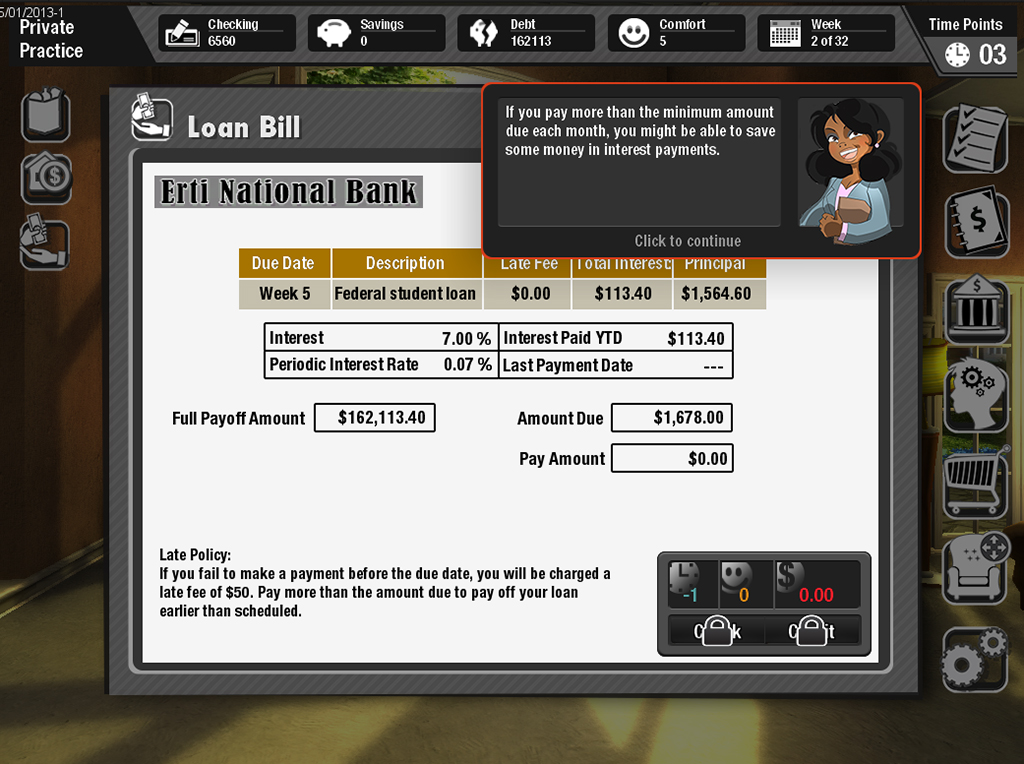

The student will identify the procedures and analyze the responsibilities of borrowing money.

The student will describe and explain interest, credit cards, and online commerce.

The student will identify and explain consumer fraud and identify theft.

The student will explain and compare the responsibilities of renting versus buying a home.

The student will describe and explain how various types of insurance can be used to manage risk.

The student will explain and evaluate the financial impact and consequences of gambling.

The student will evaluate the consequences of bankruptcy.

The student will explain the costs and benefits of charitable giving.

About Mind Your Own Budget (MYOB)

MYOB is designed to show students that the key to financial health is simple: Spend less than you make. Students are expected to set and follow a monthly budget and regularly monitor their checking and savings accounts while avoiding debt. However, students must balance their comfort level as well. In order to win the game, players must achieve and maintain the game goals for each scenario (such as savings, debt, and comfort goals) before time runs out.

MYOB contains ten scenarios, each dealing with different financial challenges and covering a mixture of financial literacy objectives. In each scenario, the player will earn a paycheck every four weeks. After they deposit their paycheck, they are prompted to set a budget for the next four weeks. Then they are free to determine how to spend their TIME, COMFORT, and MONEY, by choosing from any of the options on the screen, from paying bills to going shopping.

Every action the player takes in the game will impact their score in one of these three areas. If the player does not have enough time, comfort, or money to complete an action, the Perform button will be disabled. They will have to either choose a different action or perform an action that will give them enough resources to complete it.

Once the player has used all of the time points allotted for each four-week period, they will see a monthly summary, which provides feedback on their performance during that time. In order to win the game, the player must MEET or EXCEED the minimum SAVINGS REQUIREMENTS, DEBT REPAYMENT GOAL, and COMFORT LEVEL set out at the beginning of the scenario. Throughout the game, the player must strategically use their time, comfort, and money in order to achieve and maintain the scenario goals.

Lesson Snapshot

Mind Your Own Budget is a Game-Based Learning program that takes students through a course on financial literacy. Students can play on their own or with peers. MYOB plays on your Chromebook or Web browser. Progress is saved automatically so students can pick up where they left off on any device.

Media

Game Resources

In addition to full implementation support, the K20 Center provides the following documents to help instructors effectively integrate Mind Your Own Budget (MYOB) into their classrooms:

Download AllK20 Game Based Learning

To use K20 Games in your classroom free of charge, please click the button below and create an account on the K20 Game Portal.

Get GamesAwards and Publications

Gold Star Award: The Nine Things Every College Student Should Know About Money (2015). National Association of Student Financial Aid Administrators. University of Oklahoma’s “The Nine Things Every College Student Should Know About Money,” was a course created to provide students with an understanding of personal finance and how financial decisions will impact their lives going forward. The Mind Your Own Budget: The Apartment game is a component of this course.

Wilson, S., Williams, L., Thompson, W., Kuehn, E., Black, J., Dean, S., Elizondo, J., Terry, R., Garn, G. (2020). The power of application in learning life skills: A case study of a game-based learning approach. In O’Hair, D. & O’Hair, J. (Eds.), The Handbook of Applied Communication Research: Volume 2. Hoboken, NJ: John Wiley & Sons.

Bergeron, L., Thompson, W., Wilson, S. (2016, July). NCCEP/GEAR UP Annual Conference: GEAR UP for Gaming: A Financial and Information Literacy Digital Game-Based Learning Experience. Washington, D.C.

Thompson, W., Elizondo, J., Wilson, S. (2014, July). NCCEP/GEAR UP Annual Conference: Financial Literacy Fun: Financial Learning through Simulated Game-Based Learning. San Francisco, CA.

Game Support

If you have an issue with any GBL product, click the button below to visit our support page. From there, you can view frequently ask questions, access useful guides, or contact support.

Request Support