Summary

When you're hanging out with your friends, do you find that they are always asking you for advice on how to save their money or how to find the best deals on the things they like? If so, a career as a personal financial advisor may be the one for you! In this career exploration activity, you'll learn what financial literacy means and how to budget your own personal expenses, playing the online game "Mind Your Own Budget" through the K20 Center's game portal. You'll also lend your own expertise to students like you who strive to make good financial decisions. Finally, you'll listen to an interview with a professional financial advisor to learn what your own career as a financial advisor might be like.

Overview

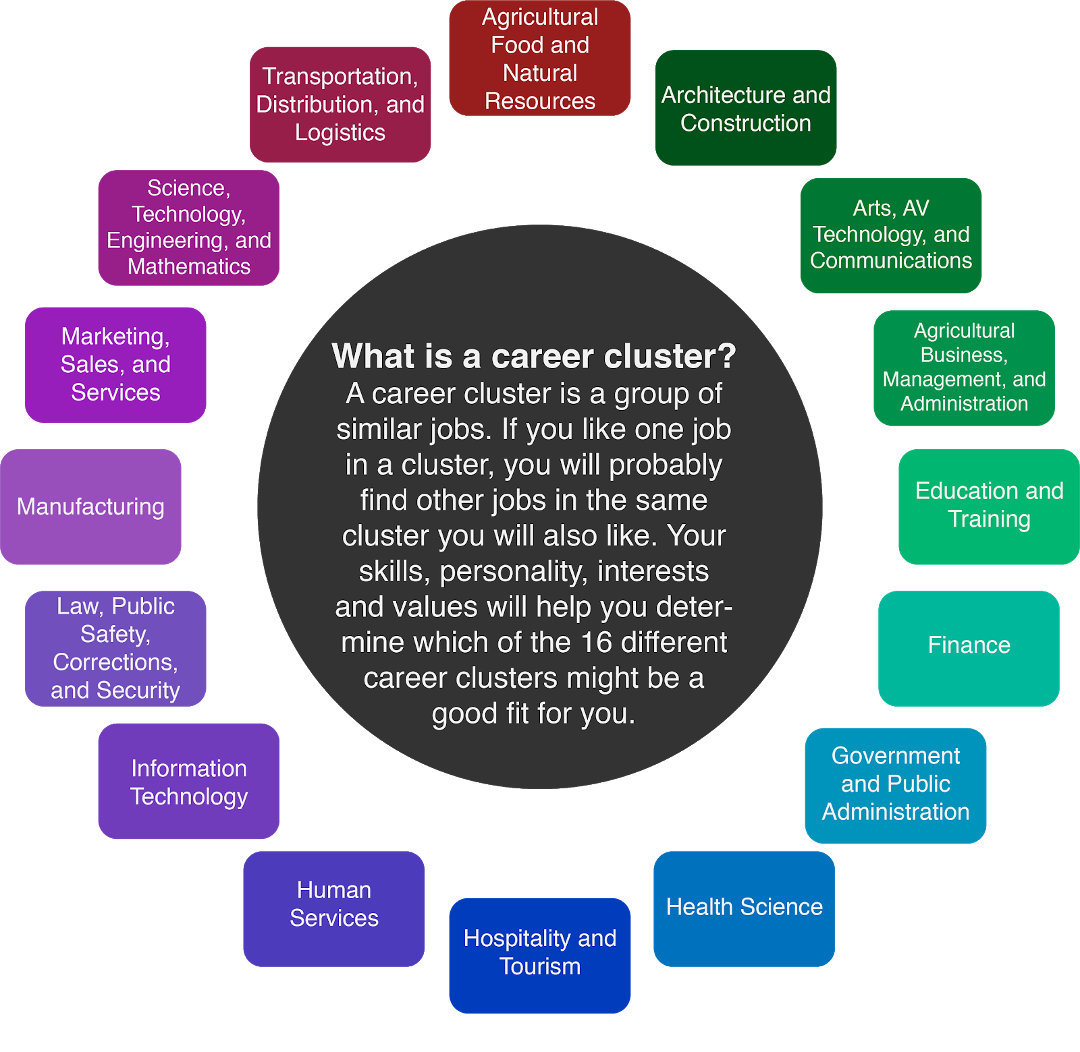

Do you find that, when you’re hanging out with your friends, they are always asking you for advice on how to save their money or how to find the best deals on the things they like? If so, a career as a personal financial advisor may be the one for you! As a financial advisor, you can give advice to your clients every day on a variety of topics dealing with money. This career falls under the Finance career cluster.

Financial advisers meet with people who want help with investing their money, have questions about tax laws, or need support making important decisions about insurance. They don’t just look at what a client needs for the short-term, they also help them make long-term financial decisions like expenses for education and retirement.

Each day, personal financial advisors use math to help them solve problems. They also use their communication skills—speaking and writing—to explain information to their clients. Being able to explain information in a way that the client can understand is an important part of the job. The average salary for a personal financial advisor is $87,850 but can range from $42,950 up to $208,000+ depending on postsecondary education and experience.

Personal financial advisors typically do the following:

Meet with clients in person to talk about their financial or money goals.

Explain the types of skills and financial services that they can use to help a client.

Answer questions about money making options and the potential risks involved in each one to their clients.

Recommend investments to clients.

Select investments for their clients.

Help clients plan for major events in their lives, such as education expenses or retirement.

Keep track of their clients' accounts.

Make decisions about clients’ accounts or investments if changes are needed.

Research different and new investment opportunities.

Many financial advisors offer advice to their clients, and some specialize in areas like retirement. Once they invest money for a client, they report to the client about how the investment is doing. Together, the financial advisor and client talk about how the investment is going and what adjustments they might make.

Being dependable, having integrity, and paying close attention to detail are important qualities to have as a financial advisor since you will be making decisions for other people about their money. It’s also important to have genuine concern for your clients so they know they can trust you.

Snapshot

Engage

Students are introduced to the concepts of financial literacy, budgets, and career options.

Explore

Students use activities from the Student Literacy Guide to identify strengths and weaknesses in their financial habits.

Explain

Students examine different careers to determine positive and negative aspects of each.

Extend

Students will interview a banker to determine their financial potential.

Evaluate

Students will review the information they have gained and complete a 3-2-1 assessment of their new financial knowledge.

Materials List

Internet access

Pencil or Pen

Blank paper (optional)

Access to the Mind Your Own Budget game from the K20 Center game portal (https://k20center.ou.edu/getgames/) on a computer OR the Mind Your Own Budget iPad app OR

Show Me the Money Student Guide (attached; optional)

Activity 1—Financial Literacy Reflection (included below and on page 4 of the attached activity booklet)

Activity 2—Mind Your Own Budget (included below and on page 6 of the attached activity booklet)

Activity 3—Budget Basics (included below and on page 10 of the attached activity booklet)

Activity 4—Practicing Financial Literacy (included below and on page 13 of the attached activity booklet)

Extend—Career Talk (included below and on page 16 of the attached activity booklet)

Mind Your Own Budget Student Guide (attached)

What to Do

You can use the attached Show Me the Money Student Guide for the activities on this page. The Student Guide can be viewed on your computer or printed out. You can also use blank paper.

Start with Activity 1: Financial Literacy Reflection and explore the financial decisions students like you make every day.

Move to Activity 2: Mind Your Own Budget and play an online game to achieve your virtual financial goals.

Move to Activity 3: Budget Basics and create a budget for your own day-to-day expenses.

Move to Activity 4: Practicing Financial Literacy and advise students as they practice—or show a lack of—financial literacy.

After you finish these activities, check out the Extend, where you can watch an interview with a real professional financial advisor to learn what your own career as a financial advisor might look like.

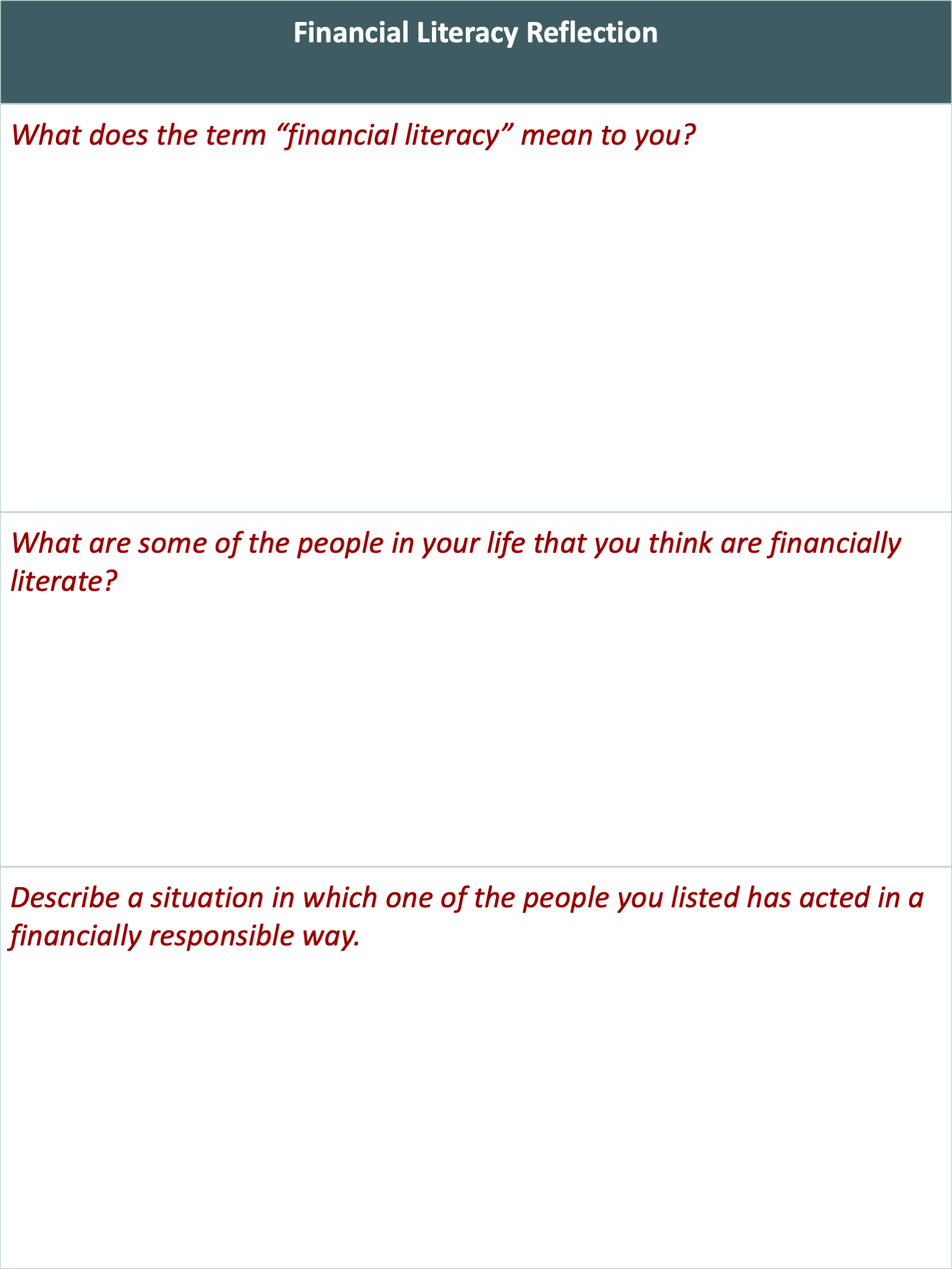

Activity 1: Financial Literacy Reflection

Whether you realize it or not, you make financial decisions every day. Because of that, it’s important to be financially literate. But what does being financially literate actually mean?

In this activity, you will explore financial literacy through games, videos, and activities that simulate real-life scenarios you or your clients may face! To be a successful personal financial advisor, it is important that you are also successful in financial literacy.

Materials:

Internet-enabled device

Pencil or pen

Instructions:

Watch Ryan Broyles, former NFL player, discuss financial decisions he made as a high school student here: MYOB: Ryan Broyles - High School

Complete the financial literacy reflection below.

Financial Literacy Reflection:

Take some time to reflect on your own definition of "financial literacy" by answering the questions below. This is not a quiz, and there are no right or wrong answers. This activity is a place for you to start creating your own definition of financial literacy.

Activity 2: Mind Your Own Budget

Materials:

Internet-enabled computer or iPad

Instructions:

Watch the Mind Your Own Budget Training Video.

Read "Mind Your Own Budget Goals" below.

Review the attached Mind Your Own Budget Student Guide.

Play "Mind Your Own Budget," completing the unit. (See the note "Accessing the Game ‘Mind Your Own Budget’" in the Overview section above for details on how to request access to play the game.)

Mind Your Own Budget Goals:

Save at least $1,000.00.

Have less than $100.00 in debts.

Have at least 5 comfort points.

This unit of the game gives you a theoretical three months to complete the goals above. You’ll have at least 5 time points per week with $2,070.00 per month to do so. This should take at least 1-2 class periods to play. Remember, your time points represent the time you have to spend! You start the game with 50 comfort points.

Activity 3: Budget Basics

Materials:

Pencil or pen

Sample budget and budget template (below)

Instructions:

Read "Budget Basics" below to learn about key vocabulary words such as income, expenses, budget, tracking, and current balance.

R

eview the sample budget table.

Use the budget template to create your own budget.

Budget Basics:

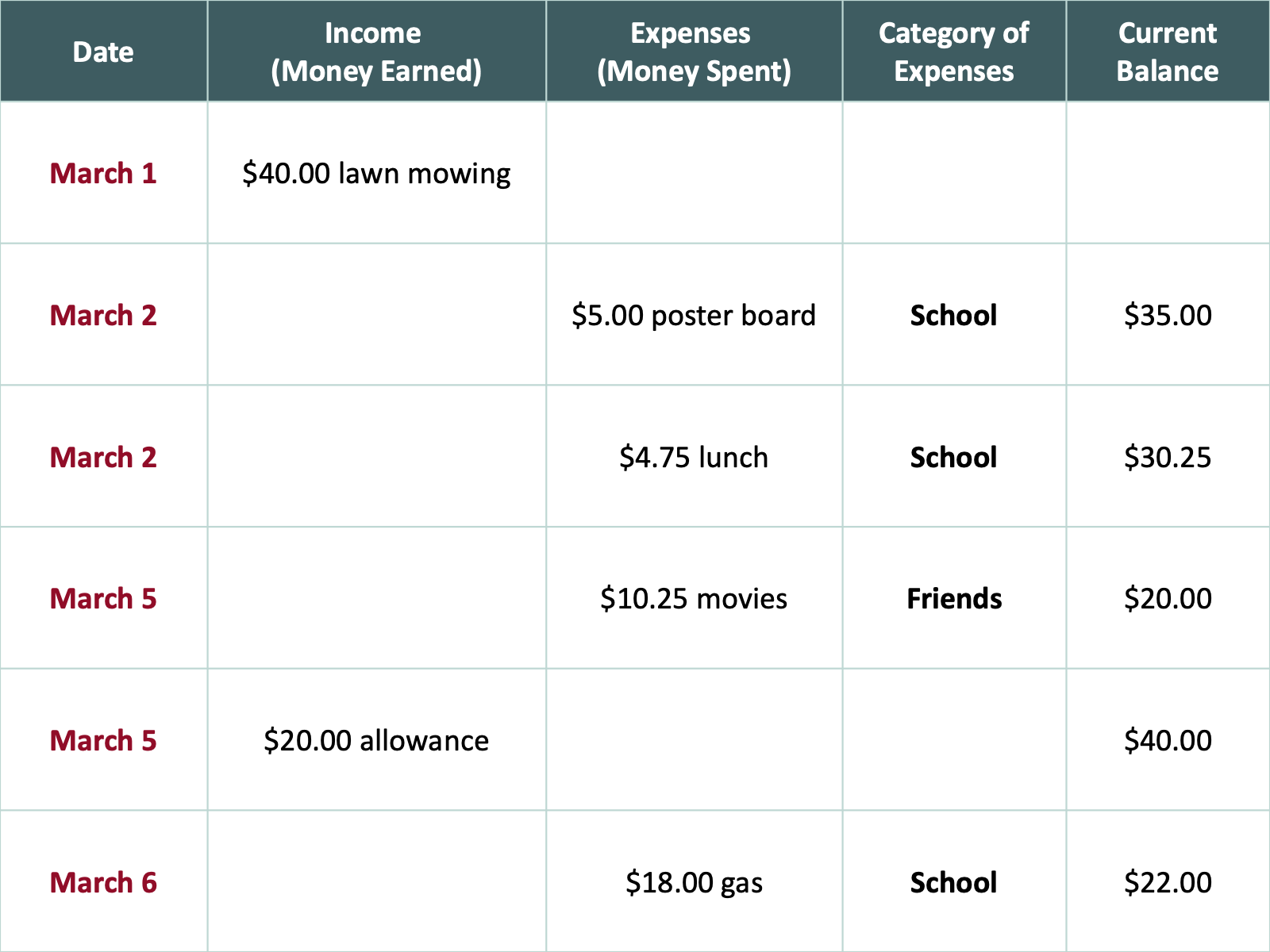

Financial literacy begins with how much is coming into your pocket, or your income, and how much is going out, or your expenses. Income can be from many different sources—an allowance, a part-time job, chores, etc. In the video from Activity 1, Ryan Broyles mentioned that his income in high school came from a part-time job at Albertson's grocery store, refereeing sports events, and lawn mowing. How do you earn income?

Expenses are how you spend your money. Is it for food, gas, going to the movies, or monthly cell phone bills? If you pay for anything by yourself, it is considered an expense.

People who consider themselves financially literate usually maintain a budget, which is a basic financial literacy tool. They keep track of their money each week or each month so that they have more income saved than expenses. Keeping money you earn is never a bad idea, right?

Pictured below is a simple budget template. Use it to think about how you earn and spend money.

The amount of money in your possession can be income earned from a job or chores. It can be given to you, as with an allowance. Income is money you receive periodically.

Once you know the amount of money in your possession, you can then determine how it will be spent. Is your priority to save as much as you can—maybe to save for something special—or just to spend your money wisely? By tracking your money, you can begin to see patterns of how your money is spent. For example, if you buy your friend a birthday present, you may wish to track the expense as "friends" or "social." If you need school supplies, you might track that expense as "school" or "required." The categories you use are up to you.

Using this type of budget, you can keep track of how much money you have left in the Current Balance column. Notice that there are many expenses related to school. If you do not wish to spend that much money for school, how can you save? Can you pack your lunch rather than spend $4.75? Can you ask friends for gas money if you are picking them up for school? These are questions only you can answer, and they are based upon choices about how you spend your money.

Activity 4: Practicing Financial Literacy

Materials:

Pencil or pen

Instructions:

Read "Practicing Financial Literacy" below.

Read scenarios 1-6. Create a graphic organizer like the one below to respond to each scenario, determining whether the student in each case is being financially literate and responsible.

Practicing Financial Literacy:

By now, you have watched a few videos about financial literacy, played Mind Your Own Budget, and created a simple budget. You should have some idea of what it means to act financially literate and responsible with money. Below are some scenarios where students may or may not be acting financially literate. For each scenario, determine if the student is being financially literate or responsible. Justify your answer, including your reasoning, in the table provided below.

Scenario #1

Sarah has a babysitting job and has earned $30.00 for babysitting for a family in her neighborhood. She would like to expand babysitting to other families in her neighborhood and is willing to spend $15.00 of her earnings to have flyers printed.

In spending half of her money on flyers, is Sarah being financially literate or not? Explain your reasoning.

Scenario #2

Brian is considering several colleges to attend after high school. He has saved some money but knows he will need much more to make it through his first year of college. He is only researching local colleges that offer multiple scholarships or low tuition costs. He is also considering living at home his first year to save money.

Is Brian being financially literate or not? Explain your reasoning.

Scenario #3

Ellen receives a weekly allowance. Her parents have explained that this is the only money Ellen will receive for seven days (weekly). Her parents have determined her allowance on the cost of the food in the cafeteria ($35) along with some extra money for hanging out with her friends ($20). Ellen’s parents pay for her cell phone, her clothes, and school supplies. Ellen leaves campus every day for lunch with her friends, hangs out at the mall once a week, and contributes some gas money for her friend’s car for driving her around. Her money never lasts the entire week, so she is planning on asking her parents for more allowance money.

Is Ellen being financially literate or not? Explain your reasoning.

Scenario #4

Kristen’s mom set up a checking account with the bank for Kristen’s expenses. She has given gave Kristen a debit card to use. Kristen once overdrew her bank account, and her mother paid the penalty fees. She told Kristen that if she overdraws again, she will have the bank close the account. Kristen has decided to check her account online about every three days to see if her account balance is getting low.

Is Kristen being financially literate or not? Explain your reasoning.

Scenario #5

Mathias is saving for his first car, which he hopes to purchase within the next year. By Mathias’ calculations, if he saves all his money from his part-time job, he can pay for two-thirds of the car he wants. For the last third of his car payment, he plans to ask his parents to give him a loan, which he will pay back with 10% interest.

Is Mathias being financially literate or not? Explain your reasoning.

Scenario #6

Luke is in his first year of college. He is struggling to pay his bills and all the extra expenses that he was not prepared for. He has three credit cards. To cover all his expenses each month, he uses one of the credit cards so that he won’t go in debt. He tries to rotate each credit card so there is not too much money on any one card. He is making the minimum payment on these cards.

Is Luke being financially literate or not? Explain your reasoning.

Look back at your definition of financial literacy from Activity 1. Below, rewrite and add to this definition by including the knowledge you have learned here and through playing Mind Your Own Budget.

Extend: Career Talk

Interview with a Real-Life Banker

Cameron Brewer serves as vice president of BancFirst’s Commercial Capital division. Cameron brings over ten years of public, non-profit, and private sector experience to his position with BancFirst, where he started in May 2018. Cameron previously worked as vice president of the Center for Economic Development Law, developing financial scenarios for community revitalization plans across the state of Oklahoma. He received a master’s degree in public administration with a concentration in local government finance from The University of North Texas, as well as a Bachelor of Business Administration focused on entrepreneurship with a minor in architecture from the University of Oklahoma.

Watch the interview to learn more about what it’s like to be a full-time banker: Banking – Cameron Brewer – Zoom Into Your Career.

Evaluation

After viewing Cameron’s career talk, reflect on the video by completing the following 3-2-1 reflection. Record your answers.

What are 3 things about Cameron’s job that you found interesting?

What are 2 new things you learned?

What is 1 thing you’re still curious about?

Sources

CareerExplorer. (2019, November 14). What does a financial advisor do? https://www.careerexplorer.com/careers/financial-advisor/

NextThought. (2020, September 22). MYOB_04_Credit Crunch_v2. https://vimeo.com/168199149

NextThought. (2020, September 22). MYOB: Jay Hannah - 01. https://vimeo.com/161062326

NextThought. (2020, September 22). MYOB: Jay Hann - 03. m https://vimeo.com/164309016

NextThought. (2020, September 24). MYOB: Ryan Broyles - High School. https://vimeo.com/161188298